Take Your First Step

Contact Us

Investment advisory services offered through Brookstone Capital Management, LLC (BCM), a registered investment advisor. BCM and Guardian Financial Management are independent of each other. Insurance products and services are not offered through BCM but are offered and sold through individually licensed and appointed agents.

The content of this website is provided for informational purposes only and is not a solicitation or recommendation of any investment strategy. Investments and/or investment strategies involve risk including the possible loss of principal. There is no assurance that any investment strategy will achieve its objectives.

Registered Investment Advisors and Investment Advisor Representatives act as fiduciaries for all of our investment management clients. We have an obligation to act in the best interests of our clients and to make full disclosure of any conflicts of interests. Please refer to our firm brochure, the ADV 2A item 4, for additional information.

Any comments regarding safe and secure products, and guaranteed income streams refer only to fixed insurance products. They do not refer, in any way to securities or investment advisory products. Fixed Insurance and Annuity product guarantees are subject to the claims’ paying ability of the issuing company and are not offered by Brookstone.

As a business, you need to be able to depend on your staff. Unfortunately, they’re human, and that means that they can experience health struggles, including disability and even death. When this happens, it can put serious strain on the company, and key person life insurance is there to help you manage while you look for a suitable replacement. This is an insurance policy that’s taken out by the company, and it provides some added security.

If you need to plan for your future, talk to Guardian Financial Management. Our team understands the nuance of wealth management, retirement planning, and more, and we’re ready to help you understand whether key person life insurance is right for your business. When you have an employee or top executive who means something special to your company, ask if covering them through a key person life insurance policy is your net move.

Learn more about key person life insurance policies. Call Guardian Financial Management today to schedule a time to talk.

What Exactly Is A Key Person Life Insurance Policy?

A key person life insurance policy is a plan that’s taken out by the employer on behalf of an executive or high-ranking employee. It’s also known as keyman or key employee insurance, and its goal is to protect the interests of the business. Companies rely on their staff, and when one member experiences death or disability, it can lead to some major institutional chaos. These policies are designed to help businesses navigate life after losing one of their needed employees.

Now, who qualifies as a key person? In order to meet criteria for these plans, the team member must be of a certain importance, whether due to organizational structure or unique skill level. Common people who fall into this category are business owners and top executives, who play a vital role to the company’s success. Certain technicians and salespeople can also be covered, as well, since their skills might not be easily replaced.

What Can These Policies Cover?

If you’re thinking about a key person life insurance policy for integral members of your team, it’s important to work with a trusted financial planner to figure out which one works best for your needs. These plans can operate in a few different ways, so you want to find the one that’s right for your business. Most offices opt for a combination of death and disability insurance, helping to maintain a comprehensive insurance solution.

Protect Your Team With Guardian Financial Management

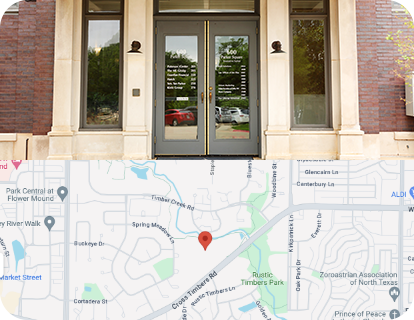

When a member of your team dies unexpectedly, it can take its toll on your business. To find out more about key person life insurance, talk to Guardian Financial Management in Flower Mound, TX today.